R.Thyagarajan is an industrialist and founder of Shriram Group, a financial services conglomerate. In 1961, he joined New India Assurance Co. Limited, a general insurance company as a management trainee. He was in charge of a branch in Guntur, Andhra Pradesh. This got him in touch with commercial vehicle owners. They were paying truck insurance premium of Rs 2,000 where as to get a fire insurance premium of Rs 600 it was a hell of a job. Hence he focused more on the commercial vehicle owners. In order to purchase a vehicle the truck buyers had to borrow money from the local private lenders at a very high interest rate. Thyagarajan felt that commercial vehicle buyers should have been given a fair chance of survival and not be burdened with high interest rates. He understood that they would be able to repay loans and it was just a matter of time. Hence he realized that because these segment of customer were neglected by other financial institutions, someone had to extend credit to them at reasonable rates. He pooled Rs 30 lakh from a new set of six private lenders to lend money for 100 trucks. Thus the seeds of Shriram Transport Finance was sown.

Business

Shriram Transport Finance Company (STFC) was established in 1979. The company is headquartered in Mumbai, India. It is the largest asset financing Non Banking Finance Company (NBFC) having 25% market share in preowned and 6% share in new commercial vehicles financing. It has Pan-India presence through a network of 630 branch offices and 575 rural centers. It lends money to first time users and driver-turned-owners to purchase commercial vehicles shown below.

The company since inception has been focused on first time users and driver-turned owners who were underbanked and had no access to affordable funds. Being the first time entrepreneurs, they had access to limited funds, which was insufficient to be offered as equity for a new CV. As a result, this segment was more inclined to buy pre-owned CVs – preferably 5-12 year owing to the immense price difference. As a result, the company chose to focus on the 5-12 year old segment. The pre-owned CV market is largely unorganized and under penetrated with 65-70% market share with private financiers presenting enormous business opportunity for a sustainable long term growth. STFC is the only organized player in the preowned CV controlling 25% of market share. The preowned CV portfolio comprise of ~76% of the Company’s total portfolio. From the image given below we can see that STFC has a lot of room to grow. Private financiers are funding Rs 562.5 billion (750 * 0.75) which STFC can go after.

As of 31st December 2013 the company had lent money to 1.1 million customers. How does it manage to lend money to so many customers? In order to do this it operates 630 branch offices and 575 rural centers. The company has 18,078 employees of which 11,243 of them are product executives. These product executives are (1) responsible for finding the customers (2) valuing the preowned vehicle (3) finance the purchase (4) collecting interest and principle from the customers. On average a product executive handles 98 customers (1,100,000 / 11,243). The executive who financed the loan is responsible for collecting the interest and principle. As the incentives are aligned properly, the executive will underwrite the loan responsibly. Also the executives are required to meet their customers at least once a month. Hence this is a people oriented business. Over 70% of the customer transactions are done in cash as the customers do not have banking habits. It takes 9+ months to train and put the executive in operations. Hence this is a knowledge oriented business. From the table given below you can see that the number of branches, executives, and assets increase along with the customers.

Given below is the asset under management breakdown of different types of vehicles the company financed for. M&LCVs stand for Medium and Light commercial vehicle. HCV stands for Heavy commercial vehicle.

As of 31st December 2013 the company had assets under management of Rs 49,676 crores. From whom did it get so much money from? It borrows money from institutions, banks, and retail customers. Since STFC is in lending business it needs to deal with two kinds of risks (1) Interest rate risk (2) Asset-Liability mismatch risk

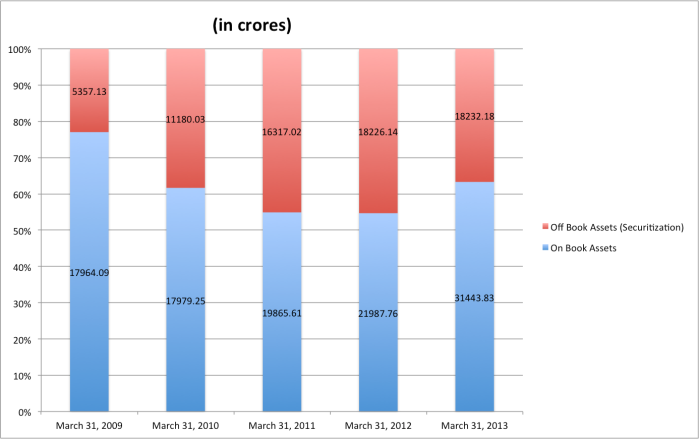

Interest Rate Risk – The company borrows money at fixed and floating rates and lends money at fixed rate. This makes the company interest sensitive on the liability side. Imagine that the company borrowed money at a floating rate of 10% and lent it out at a fixed rate of 20%. It has a good interest margin of 10%. If its floating interest rate suddenly goes up to 15% then its margin reduces to half and becomes 5%. It mitigates this risk by a concept known as securitization. STFC bundles some of its assets and sells it to the banks. Banks pay money to buy these assets and in turn excepts a fixed rate of interest. Thus by securitizing STFC converts its floating rate liability to a fixed rate liability. Since these assets qualify as priority sector lending the banks are willing to take a lower interest rate and this results in better margins for STFC. Also as these assets are sold to banks, it is removed from the balance sheet of STFC and hence they are called as off book assets. Given below is the split of on/off books assets.

Asset-Liability mismatch risk – If STFC uses short-term liabilities to fund long term assets, it could result in a liquidity crunch affecting its ability to service loans. In order to mitigate this it ensures that the short term and long term sources of funds are favorably matched with deployment. In recent years the company is moving to long-term sources of funds in the form of equity and debt. From the image you can clearly see that the company prefers funds from banks and institutions as they are long term funds.

I have uploaded STFCs 10 years profit and loss details on a standalone basis here. For the 10 years total income grew at a compounded rate of 38.16% and profit after tax grew at a rate of 43.46%. Also during this period the average: finance cost is 47.03%, operating cost is 26.57%, and profit after tax margin is 17.36%. From the chart we can see that during 2008 and 2009 the finance cost went up. This is understandable because of the global recession and the company does not have much control on finance costs. Also the operating cost has gone down steadily which helped the company to improve its profit after tax margin. The company invests heavily in information technology. It has 270+ technology experts in house who build and manage the software and hardware. Nothing is outsourced. The entire stack is built on the .NET platform. Five years back, claims were settled in 7-8 months but with the help of better technology it can be now be settled in just 40 days. Right now one field officer manages 100 customers. With the help of better technology it is hoping to increase this number to 200. This will keep the marginal cost of acquiring additional customer low and will result in better profit margins.

Moat

Capitalism guarantees that competitors will emerge like bees to honey and will try to take away your market share. Moats are structural characteristics of the business that will create barriers for the competitors to enter into your turf. Let us do a porters five force analysis on STFC.

Threat of New Entrants – There are several entry barriers that a new entrant has to deal with (1) Operate in a highly regulated NBFC industry (2) Preowned vehicle financing is a business model that is built on top of people relationships. You need to hire and train local talent in order to deal with people in different states (3) Finding out the value for a new vehicle is easy as you will have an invoice. For a preowned vehicles there are no invoices and hence you need to develop expertise on the product valuation (4) Asset and the borrower are always on the move (5) Most of the borrowers do not have banking habits. Hence you need to deal with a lot of cash transactions. From all this we can tell that threat of new entrants is very low.

Bargaining power of suppliers – Banks and Institutions supply funds to STFC. They supply funds to several others and hence they have some control over cost of lending. Hence the bargaining power of supplier is medium.

Bargaining power of buyers – Potential commercial vehicle owners are its buyers. No banks will lend money for buying preowned vehicle. The only alternative is to go to private financiers. But they charge very high interest rates. Hence they all come to STFC. The bargaining power of buyers is very low.

Threat of substitutes – Commercial vehicle buyers do not have a lot of money to fund the vehicle purchase from their savings. They need to borrow money. Hence the threat of substitutes is very low.

Rivalry among existing competitors – Around 76% of STFC financing is done to preowned vehicles. There are no organized players in the preowned vehicle segment. Hence the threat of competition is very low.

From Porter’s analysis we can see that there exists a huge moat in the business. Let us prove the existence of moat by looking at return on assets (ROA) and return on equity (ROE). I compared STFC returns with HDFC Bank; one of the best banks in India. Comparing these two business is like comparing apples and oranges. But it at least gives me a way to see the existence of huge moat in STFCs business. For STFC the 10 year average ROA is 2.68% and ROE is 23.78%. For HDFC Bank the 10 year average ROA comes to 1.29% and ROE is 14.05%.

STFC is in the commercial vehicle lending business for 30+ years. Over the years it has built a network of (1) Bankers and other private financiers (2) Customers (3) Well trained and knowledgeable employees (4) Branch office and rural centers (5) Information technology. It started lending for the purchase of trucks. Then it extended this to cover passenger vehicles and generalized the platform to cover all commercial vehicles.

It then went on to create a subsidiary called Shriram Equipment Finance Company Limited. This subsidiary lends money to a wide range of preowned and new commercial construction equipment like forklifts, cranes, loaders, etc. As of March 31st 2013 it had an asset under management of Rs 3,041 crores with a net profit of Rs 89.33 crores. It then went on to create another subsidiary called Shriram Automall India Limited. Automall is a platform where buyers and sellers can trade vehicles. It provides transparency in valuation process, backed by assured title, quality and performance of the vehicle. As of March 31st 2013 it had an asset under management of Rs 75.35 crore and a profit after tax of Rs 13.96 crores. Automall also helps STFC to perfect its valuation process for preowned vehicles. Recently the company started lending to purchase cars.

STFC is diversifying its income stream using its core network is analogous to Coca-Cola spinning of different drinks like coke, diet coke, and cherry coke using its core formula.

Management

It is easy to go crazy in lending business and start lending money to grow the business without giving any considerations to the quality of the loans. This is what happened before the global financial crisis. People without a job nor a downpayment were given mortgages to buy homes. It is up to the management to ensure that the quality of loans is not sacrificed to achieve growth. This is what the STFC management told in their 2012-13 annual report.

However, catering to a customer segment that personally utilizes the asset to earn livelihood, the demand for pre-owned vehicles remained high, especially with increased presence in new rural and semi-urban centers for the company. The only challenge remained in view of an uncertain economic growth was to safeguard the quality of assets – a trait that we at Shriram Transport have always taken pride in. Therefore, we chose good business over easy business; in other words, we continued to grow responsibly by keeping our asset quality intact.

There are two non performance asset (NPA) metric to find out the quality of assets. They are called Gross NPA and Net NPA. Here is a decent article which explains this concept in layman terms. In general lower the gross NPA better the quality of assets. Net NPA between 0 and 1 tells that the company is good in estimating losses. STFCs Net NPA averages at 0.69 which tells that the management is doing a good job in provisioning for losses.

Let us do Buffett’s earnings retention test for STFC on a 5 year rolling basis to understand how efficiently the management is allocating capital. If you want to understand how it is calculated you can read here. As you can see from the table below, In all five periods the management has produced at least to Rs 2.8 for every Rs 1 retained. This shows that the management is doing a good job in allocating capital.

Valuation

Lending companies balance sheet consist mostly of financial assets with varying degrees of liquidity. Hence book value is a good proxy for the value of STFC. As of 31st Dec 2013 the book value is Rs 315.58. The closing price of the stock on 28th Mar 2014 is Rs 738.35. The price/book comes to 2.33 (Rs 738.35 / Rs 315.58). Is this cheap? Let us look at the history of STFC and figure out the answer for this question. From the chart you can see that anytime the book value goes above 2.5, the market cap comes down a lot. In the last two months STFC stock was very volatile. On Feb 19th 2014 STFC (NSE:SRTRANSFIN) was selling for Rs 556.10 which gave it a price/book of 1.76. I would prefer buying the stock when price/book is around 2.

Let us look at the valuation another way. As of 31st March 2013 the consolidated diluted EPS comes to Rs 64.51. On the current stock price of Rs 738.35 the earnings yield comes to 8.73% (Rs 64.51 / Rs 738.35). The current yield on a 5 year fixed deposit from SBI comes to 8.5%. You are getting a better yield on STFC with an enormous room for the business to grow. Also Ajay Piramal paid Rs 723 per share for Shriram Transport. At the current price you are paying what Piramal paid for SFTC.

I do not own shares in STFC. I will start to buy if its price/book sells around 2. STFC is in a highly regulated and cyclical industry. Hence one should be prepared for a bumpy ride and not confuse volatility with risk. This is what Buffett wrote in 1995 letter.

Charlie and I, however, are quite willing to accept relatively volatile results in exchange for better long-term earnings than we would otherwise have had. In other words, we prefer a lumpy 15% to a smooth 12%. Since most managers opt for smoothness, we are left with a competitive advantage that we try to maximize.

A wonderful analysis.. As per my thinking, the stock is overvalued.. I am waiting for a correction..

Dileep,

Thanks.

Yes I would wait for to trade around 2 times price to book.

It ran up a lot in the last 2 weeks.

May be the stock knew that I started analyzing 🙂

Regards,

Jana

Likewise muthoot capital is also an investment pick with 5% dividend yield and huge room for the company to grow !!

The businesses are very different in their character – Cv financing is to people who would be utilizing the asset to make money while in case of 2-wheelers – its a consumption – so u r not funding an income generating asset and therefore the risk of delinquencies goes up. Also, the size makes a lot of difference to build a moat. I can’t imagine of a moat that a 2-wheeler financing business can have where it can be better than others or get better than others over a period of time. The 2-wheeler as such does appear to be saturated and with ticket size of less than Rs. 1 lakhs – the opportunity to finance it is very small. So, there is very limited scope for growth for the industry as a whole and in that no one can have a moat to be able to do better than the competition. so, I would feel that Shriram Transport Finance or even Sundaram Finance for that matter is a much better business to own.

I have a small farm just opposite to one of STFC’s yards and whenever I am on my farm, I have been eyeing the activities there, especially auctions of the seized vehicles. Though the auctions brought some negative thoughts in me about STFC, on detailed analysis of the business as a whole, the overall numbers seemed very much impressive. However, by the time I made up my mind to go for STFC’s shares, Mr. Market has already become manic! Now I am waiting for Mr. Market to become depressed. I love the business of lending where money makes money with no requirement of land, plant, and machinery. Housing finance is my favorite. You share my views and your post has further strengthened my thoughts about STFC. Keep sharing similar thoughts/stock ideas.

Thanks Raj.

Regards,

Jana

Good analysis Jana . However I would like to make a few observations :

1. You have not dealt with the ownership structure of STFC . I believe there is some sort of trust structure in place , also FIIs have a good stake . Whenever one considers a stock for investment for the long term , ownership is important as owners – managers are ultimately going to deliver the goods .

2. You compares STFC with HDFC Bank , I feel a better comparison would be with Sundaram Finance another major in CV finance albeit having a focus on new vehicles .

4. Apart from banks and institutions many NBFCs like M& M finance , Tata Finance etc . are into cv financing .

5. Customer relationships make this a very localised market .

6. You talk about investing in the stock . As a non- resident is this stock listed on overseas exchanges to enable you to buy it ?

Thanks James and your observations are very good.

(1) Shriram Capital: 25.92%; Piramal Enterprises: 9.96%; FIIs: 54.69% [http://goo.gl/ZZ7tlU]

(2) Great point. For “Sundaram Finance” 10 year average ROA is 2.40% and average ROE 18.93%

(3) Yes M & M and Tata Finance do CV financing only for new CVs. Since 76% of STFC is preowned they have a huge moat.

(4) You are correct. Customer relationship is the key for making the business tick.

(5) As a non resident there are few restrictions buying Indian equities. But you should be able to work it out with institutions like ICICI and HDFC.

Regards,

Jana

Hi Jana,

Nice analysis.

One questions : what about their Capital adequacy ratios ? NBCFs are stipulated to maintain 15% CAR. We need to figure out how much can the company grow with out diluting any equity.

Rohit,

If I remember it correctly STFCs capital adequacy ratio is well over 20%+. This should not be a concern.

Regards,

Jana

First time visitor of your blog and have you say I am regular already! Amazing write up!

Btw should we look at source of funds & liquid holdings/assets if any for STFC? Just to be aware and ensure there are no hidden corners. It would also give us insight to STFC finance team’s planning!

Achin,

Thanks. Make sure you check the following

1. Short term loans matches up with short term assets and Long term loans matches up with long term liabilities. This is to ensure that the company does not face any liquidity crunch.

2. Make sure Debt/Equity ratio stays the same. If it starts to go up very high then you need to understand why.

Regards,

Jana

Hi Jana,

What a simple but very informative analysis…

Like Achin, I am first timer to your blog & simply overimpressed by analysis of STFC business.

Will be going through the other hyperlinks in the article to gain more understanding.

Best Regards,

Gov

Hi Jana,

Nice write up. I think ur views on valuations too r absolutely correct. I want to discuss more regarding securitization and income from it they generate. Can you please share your number with me on my email ashish620@gmail.com. I will call you at ur convenient time.

Thanks in advance

Ashish

Hello Jana,

I regularly read your blogs and I thank you for the amazing clarity and simplicity with which you take any topic.

Now as you have mentioned and also Prof. Bakshi have told to seriously look at high quality businesses like STF at ~2.5 times book, is it time to look at STF as it has come close to ~2 times book.

How do you see the current situation – is the moat intact or have you changed your view from your last year analysis? From concall I think the management is pretty confident to resolve this one off equipment finance issue down the road.

Thanks and Regards

Brijesh

Brijesh,

Thanks for the comments.

I own Shriram indirectly through Piramal Enterprises. And I am happy with that.

Regards,

Jana

I thought of STF when Buffet talked about Carlton Homes in BRK2015. In similarity, both have built a business model around individuals with less credit options. I think, I heard from Buffet’s interview that when the customers default, Carlton repossess the home and sell it back (looses around 40% of the value).

In case of STF, I would assume that the loan is made after considering the depreciation factor. Also STF could sell the repossessed vehicle must faster than a home as there is a greater market for used vehicles.

What do you think?

Ragu,

At the core the business model is the same. In case of STFC its customers don’t even have a bank account and more than 70% are cash transactions.

Regards,

Jana

Great analysis . AT 1.8 price to book now you buying ?

Hi Jana, Thanks for the post. Appreciate your sharing of knowledge.

One Q on valuation – Am I to understand that you are ok to buy the stock at P/B of 2 and not at 1.76. Is int is cheaper at 1.76 and hence better at lower price. Sorry if I am missing something.

Thanks,

Saisundar

Sai,

Thanks. You should read this – https://goo.gl/fYN5cc.

Regards,

Jana

Thanks Jana for the follow up post. That was very helpful.

On re-reading the above post i realized that you had used Feb 19th, 2014 as reference to highlight the volatility in price.

Besides, given the CE business in abt 5% of total BV, mkt crash of abt 20% was over-reaction in my view.

Appreciate your efforts to write down in layman terms. Its one thing to understand, but another to put things down at such granular levels.

All the best!