So far I wrote about accounting for debt, leases and taxes. You can find them all here. Companies pay its employees using cash and stocks. All cash payments made to employees are shown as expenses in the income statement. But when it comes to stock compensation things are not that straightforward. Companies pay its employees using restricted stocks and stock options and the accounting treatment for both of them is very different. In this post, I will try to unravel the accounting for stock compensation.

1. Common Stock, APIC, and Treasury Stock

In order to understand stock based compensation, you need to know few basic things about common stocks. I will explain them by using a fictitious company called TestCo. On 01-Jan-2014, TestCo issued 10,000 shares of $1 par value for proceeds of $10 per share. The company received $100,000 as proceeds from the public. Given below is the journal entry for this transaction.

01-Jan-2014 Dr. Cash $100,000 [10,000 shares * $10]

Cr. Common stock $10,000 [10,000 shares * $1 par value]

Cr. Additional paid in capital $90,000 [$100,000 - $10,000]

The journal entry increases its cash asset by $100,000. For the balance sheet to balance the company makes two entries on the liability side. The first entry is called as common stock. What does this mean? Before the advent of computers, stocks were issued in physical certificates. On each certificate the face value (also known as par value) of the stock will be displayed. This refers to the amount at which a stock is issued or can be redeemed. Thanks to status quo, even today the concept of par value is used. In this example the par value is $1 and for 10,000 shares, the total value for common stocks comes to $10,000. Any amount received in excess of par value is kept in additional-paid-in-capital (APIC). In this case it comes to $90,000. At this point the total number of stocks issued by the company is 10,000 and the total number of stocks outstanding with the public is 10,000.

On 01-Jan-2015, TestCo buys back 1,000 of its common stock at a price of $12 per share. The journal entry for this transaction is given below. This entry decreases cash asset by $12,000. For the balance sheet to balance the company makes a liability entry for $12,000 which is kept in an account called as treasury stock. A depreciation account decreases the value of fixed assets. Similarly treasury stock account reduces the value of total equity. Treasury stock does not have voting rights nor receive any dividends. They remain dormant until the company retires or reissues them. After the buyback the total number of stocks issued by the company is still 10,000 and the total number of stocks outstanding with the public is 9,000.

01-Jan-2015 Dr. Treasury stock $12,000 [1,000 shares * $12]

Cr. Cash $12,000 [1,000 shares * $12]

On 01-Mar-2015, TestCo decides to reissue 1,000 shares to public from treasury stock account at a price of $15 per share. The journal entry for this transaction is given below. This entry increases the cash asset by $15,000. For the balance sheet to balance the company makes two entries on the liabilities side. The stocks sold from the treasury account comes out at $12; original price paid by the company. The remaining $3,000 is stored in additional-paid-in-capital (APIC). This gain of $3,000 is never shown in the income statement. Why is that? If this was allowed, under the influence of incentive caused bias, every company will engage in trading its own stock in the market instead of running its business. Had TestCo reissued treasury stock at some price less than $12 then the difference will be subtracted from APIC. At this point the total number of stocks issued by the company is 10,000 and the total number of stocks outstanding with the public is 10,000.

01-Mar-2015 Dr. Cash $15,000 [1,000 shares * $15]

Cr. Treasury Stock $12,000 [1,000 shares * $12]

Cr. Additional paid in capital $3,000 [$15,000 - $12,000]

The table given below shows the effects of all three journal entries. Spend some time to make sure you really understand this.

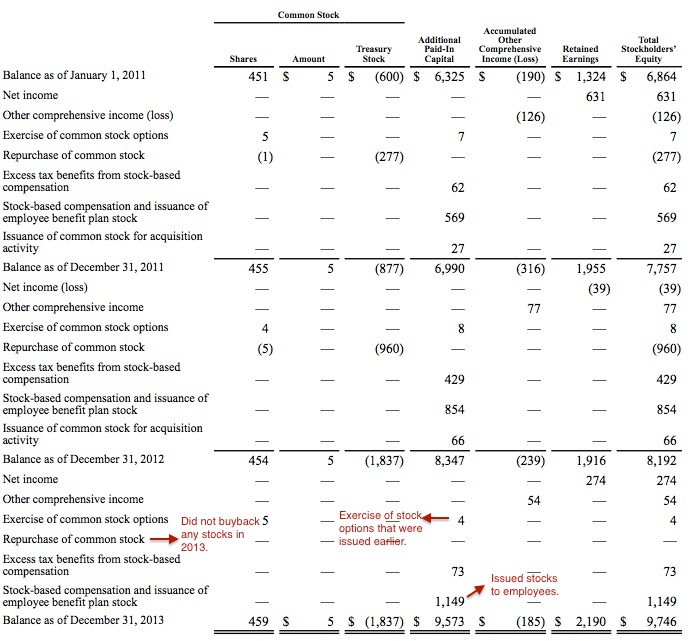

Armed with the basic understanding of common stocks, let us look at Amazon’s 2013 balance sheet given below. From this you can see that Amazon (1) issued 5 million additional shares in 2013 (2) didn’t buyback any shares as treasury stock remained the same in 2012 and 2013 (3) additional 5 million share issues resulted in APIC increasing by $1,226 million. Spend some time to go through the annotations I made in the balance sheet.

2. Paying Employees With Restricted Stock

A company can pay its employees using restricted stock. The stock is called as restricted because the employee cannot sell the stock right away and needs to wait for some period, also called as vesting period, before selling. Let us understand this with an example. On 05–Mar-2015, TestCo grants 500 shares to its CEO as compensation. On the grant date the stock price is $18. The stock vests after two years and the par value is $1. The journal entry for this transaction is given below. As the company issued 500 new shares to its CEO, it records $500 in common stock and the balance $8,500 in APIC. For the balance sheet to balance it records $9,000 in deferred compensation expense which will get expensed over the two years vesting period using straight line method. Also the total number of shares issued and outstanding goes up by 500.

05-Mar-2015 Dr. Deferred compensation expense $9,000 [500 shares * $18 per share]

Cr. Common Stock $500 [500 shares * $1 par value]

Cr. Additional paid in capital $8,500 [$9,000 - $500]

On 05-Mar-2016, TestCo recognizes $4,500 as compensation expense and the other half will be recognized on 05-Mar-2017. The journal entries for these transactions are given below.

05-Mar-2016 Dr. Compensation Expense $4,500 [$9,000 / 2]

Cr. Deferred compensation expense $4,500 [$9,000 / 2]

05-Mar-2017 Dr. Compensation Expense $4,500 [$9,000 / 2]

Cr. Deferred compensation expense $4,500 [$9,000 / 2]

3. Paying Employees With Stock Options

A company can pay its employees using stock options. For a long time, I was assuming that options are stocks. But they are not. Options become stocks at some point in future when the market price of the stock is higher than the exercise or strike price. Let us understand this with an example. On 01-Feb-2015, TestCo grants 100 options to its CFO with an exercise price set to market price of $13. The options vest after two years and expire after 10 years. The fair value of the option is $10 per share at the grant date. The last couple of sentences contains some new terminologies which needs more explanation.

The date on which the options are granted to an employee is called as grant date. In this case it is 01-Feb-2015. On the grant date the exercise price of the option is set to the market price. In this case it is set to $13. What does this mean? This means that in future, the CFO can convert these options into stocks by paying $13 for a stock. How long should he wait for this conversion to happen. He needs to wait until the vesting period is over. In this case it is two years. The CFO can convert these options into stocks between 01-Feb-2017 and 31-Jan-2025 after which the options expire. In 2005, SEC came out with a rule, rightly so, for expensing the stock options in the income statement. This means that companies needs a way to value the options. Some of the popular valuation methods are Black Scholes and Binomial Models.

In our example the fair value of the option is set to $10. Why is the fair value of the option less than the market price of $13? Options have value only when the strike price is greater than the market price after the vesting period. There is a likelihood of this not happening in the future. This uncertainty leads to lower price for options. The total value of the stock options comes to $1,000 (100 options * $10 fair value). TestCo will expense this as compensation expense over the vesting period of two years using straight line method. The journal entries for these transactions are given below. For the balance sheet to balance, APIC goes up by $500 each year.

01-Feb-2016 Dr. Compensation expense $500 [$1,000 / 2]

Cr. Additional paid in capital $500 [$1,000 / 2]

01-Feb-2017 Dr. Compensation expense $500 [$1,000 / 2]

Cr. Additional paid in capital $500 [$1,000 / 2]

Let us assume that on 02-Mar-2017, the CFO exercises his 100 options by paying $13. At the time of exercise the market price of the stock is $20. The journal entries for these transactions are given below. If the market price is $20 who sells shares to the CFO at $13? TestCo sells those shares. But from where does it gets these shares from? It gets these from its treasury stock. For this example let us assume that $12 is the average buyback price of treasury stocks. For the balance sheet to balance the difference between the exercise price and buyback price is added to APIC.

02-Mar-2017 Dr. Cash $1,300 [100 shares * $13]

Cr. Treasury Stock $1,200 [100 shares * $12]

Cr. Additional paid in capital $100 [$1,300 - $1,200]

The current market price of $20 is not relevant for this journal entry. But TestCo will get a tax deduction for $700 [ ($20 – $13) * 100 shares ] when its CFO sells his shares. Note that in stock options the capital stock account never went up. Why is that? The company never issued new shares. All it did was to reissue the stocks from its treasury account. After this transaction the total shares issued remains the same and shares outstanding goes up by 100.

4. Amazon’s Stock Compensation

Any changes that happen to shareholders equity is captured in statement of shareholders equity. Take a look at Amazon’s 2013 shareholders equity. From this we can see that (1) it didn’t buyback any stocks in 2013 (2) issued restricted stocks for $1,149 million and APIC went up by that amount (3) some stock options there were issued long back got exercised and APIC went up by that amount (4) also it did not issue any new stock options.

5. Is stock compensation really an expense?

Until 2005 companies were issuing stock options to its employees and never recognized it as an expense. Why would they do that? The rule did not require them to. Also the top management’s pay check depended on showing more profits. If you pay your employees in stock options and not recognize it as an expense then profits will go up along with their pay check. In 1994, FASB wanted to change this rule and treat stock based compensation as an expense. But companies fought against this rule by lobbying and made the senate to condemn the proposal. Buffett stood on the side of FASB but things did not change. In 2005, after a decade, law was passed to treat stock option as an expense.

Whatever the merits of options may be, their accounting treatment is outrageous. Think for a moment of that $190 million we are going to spend for advertising at GEICO this year. Suppose that instead of paying cash for our ads, we paid the media in ten-year, at-the-market Berkshire options. Would anyone then care to argue that Berkshire had not borne a cost for advertising, or should not be charged this cost on its books? … The role that managements have played in stock-option accounting has hardly been benign: A distressing number of both CEOs and auditors have in recent years bitterly fought FASB’s attempts to replace option fiction with truth and virtually none have spoken out in support of FASB. Its opponents even enlisted Congress in the fight, pushing the case that inflated figures were in the national interest. – Buffett; 1998 letter

The law fixed one problem. But corporate executives are smart and they have figured out another way to manage investors expectations. Along with GAAP earnings companies report something called as adjusted EBITDA. What does this mean? You show profits by not counting depreciation and stock based compensation as an expense. To me this is nonsense. If stock based compensation is not an expense then what the hell are they?

A few years ago we asked three questions to which we have not yet received an answer: “If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?” – Buffett; 1998 letter

As long as investors are gullible, executives can paint whatever investors want to see. Investors who believe in adjusted EBITDA reminds me of a joke told by Charlie Munger – I tell about the guy who sold fishing tackle. I asked him, “My God, they’re purple and green. Do fish really take these lures?” And he said, “Mister, I don’t sell to fish.”

Closing Thoughts

I learned these concepts by reading the book shown below. Also I took the Financial Accounting course from coursera. I would highly recommend this course for anyone who wants to know how the financial statements are put together.

I joined the course which is offered on May 4. As always, Thanks!

Thanks Ragu.

Regards,

Jana

Thanks Jana for your post. I have a couple of queries related to the example for stock options:

1) Why did you expense compensation for 500 stock options? I believe 100 options were granted. (I assume its a narrative error. Let me know if I am wrong)

2) Why did you expense option compensation using $10? Didn’t the TestCo pay $13 to CFO per option? How can we factor additional $3 per option?

Thanks much,

Gaurav

Hi Gaurav,

For (1) that was a terrible mistake from my part. I fixed it and let me know if you still find issues. Thanks a lot for pointing this out.

For (2) expenses are recognized based on the fair price of the option which is $10. The stock comes out of treasury at $12 when CFO exercises it. Since this happens in the future and there is a likelihood of this not happening. So we can’t use that as an expense.

Regards,

Jana

Hi Jana,

Thanks again for one more excellent post . I have few questions on this topic .

1) For both restricted stock and stock options , expense is recorded as deferred compensation asset and a corresponding value is added to APIC . When this deferred compensation asset is amortized let’s say in 2 years by charging income statement , I believe the deferred compensation asset value is reduced to zero . In this case how is it balanced on equity/liability side ?

2) In your Amazon example , how did you conclude that increase in APIC (1149 million )was due to restricted stock and not from stock options ? ( is it because issued shares and shares outstanding increased by 5 millions and issued shares only increase when restricted stock is granted ? )

3) How did you infer that there were no stock options issued ? Does stock based compensation and employee benefit stock plan line item in equity statement always refer to restricted stocks ?

Your reply will be appreciated

Thanks

Balaji

Hi Balaji,

Thanks for your comments.

(1) Only for restricted stocks the companies use deferred compensation expense which is a contra liability account like depreciation which reduces the liability. So to start with you increase Common stock and APIC and also the contra liability account so the net effect is zero. Over the vesting period you reduce the contra liability account and replace it with compensation expense.

(2) and (3) The footnotes clearly mentioned that they granted restricted stocks and there was no reference to stock options.

Regards,

Jana

Thanks for your explanation. I understand that the compensation expense is charged to the income statement over the vesting period and the deferred compensation expense is reduced to zero. Please check if my entries below are correct.

05-Mar-2015 Dr. Deferred compensation expense $9,000 [500 shares * $18 per share]

Cr. Common Stock $500 [500 shares * $1 par value]

Cr. Additional paid in capital $8,500 [$9,000 – $500]

05-Mar-2017 Dr. Deferred compensation expense 0 [ $9000 amortized and expensed ]

Cr. Common Stock $500 [500 shares * $1 par value]

Cr. Additional paid in capital $8,500 [$9,000 – $500]

So, deferred compensation expense asset gets amoritzed over vesting period and APIC and Common stock stays on the balance sheet.

Thanks,

Balaji

Hi Balaji,

Deferred compensation expense is not an asset. It’s a contra equity account.

Your entries for 05-Mar-2015 is correct. For the next two years, common stock and APIC will not get touched at all. Instead deferred compensation expense goes down to zero and compensation expense takes its place which in turn reduces retained earnings.

During the whole process nothing happens to the asset side of the balance sheet.

Regards,

Jana

Thanks Jana for the post. Do you think a credit investor should also be worried about stock expense accounting. Cash flows do not change materially, so why bother?

I mean only an equity investor who cares for the EPS number and potential equity dilution should be concerned.

As far as I know, credit investors needn’t worry about this.

Regards,

Jana

Hello Everyone,

As we are having discussion on stock compensation, i thought it would be timely to provide the following example of stock compensation abuse by technology corporations.

Company : QCOM

Based on the following information from footnotes, 10.4 billion dollars were spent for repurchases but shares outstanding shrinked by only 41.5 million . If we consider $70 as average purchase price during these 3 years, 2.9 billions were used for actual repurchase of shares and the rest 7.5 billions to compensate for shares dilution from RSU’s, Stock options etc

2012 10-k

—————-

The number of shares outstanding of the registrant’s common stock was 1,704,029,150 at November 5, 2012.

During fiscal 2012, we repurchased and retired 23,893,000 shares of common stock for $1.3 billion

2013 10-k

—————

During fiscal 2013, we repurchased and retired 71,696,000 shares of common stock for $4.6 billion,

The number of shares outstanding of the registrant’s common stock was 1,689,435,673 at November 4, 2013

2014 10-k

—————

The number of shares outstanding of the registrant’s common stock was 1,662,600,946 at November 3, 2014.

In fiscal 2014, we returned $7.1 billion, or 93% of free cash flow, to stockholders, including $4.5 billion through repurchases of 60.3 million shares of common stock and $2.6 billion of dividends

Shares outstanding decreased to 1.67 billion at September 28, 2014 from 1.69 billion at September 29, 2013 due to share repurchases, partially offset by net shares issued under our employee benefit plans

Regards,

Balaji

Balaji,

You will find this trend in most of the technology companies. The best way to handle is (1) to treat stock based compensation as an expense (2) also look number’s based on per share to take dilution into account. I don’t know if there is another way to handle this. But would be happy to hear.

Regards,

Jana

Jana,

I didn’t quite get your second point ? Can you please explain ?

Thanks,

Balaji

Hi Balaji,

Divide revenue, operating income, cash flows by total shares outstanding. So if the share count is going up then you will be able to adjust for it.

Also take a look at http://goo.gl/IkRTcP and search for Offsetting Options Dilution. You will like what Michael Shearn is telling.

Regards,

Jana

Thanks Jana for your input.

Hi Jana,

Thanks for your article!

What is your view on that stock based compensation are added to the operating cash flow of companies and thereby having a positive effect on free cash flow?

I remove that for calculating cash flow from operations.

Regards,

Jana

Jana – another great post thanks for sharing. Could you confirm that as of 2004 Net Income is reduced by annual option expense? I suppose this happens by the ‘Compensation Expense’ line? If that is true then should we still use Diluted Shares to calculate per share values? (seems to be double-counting if the expense is reduced and diluted shares are used.

Last thought – I believe we should take the present Fair Value of remaining unexercised options, on a per share basis, and reduce our final intrinsic value of the firm by that amount.

me again Jana – in doing more research into this topic I see FASB requires reporting the fair value of stock option expense in the Notes to Financial Statements, but leaves it as voluntary whether companies actually reduce reported Net Income (the shareholder-friendly companies will do this). My thinking is investors should:

1) check the 10-K/annual report to see whether the company voluntarily reduces Net Income by the stock-based compensation expense. If they do not then the investor should reduce Net Income by that amount reported in the Notes themselves.

2) Use Diluted Shares Outstanding – these simply account for in-the-money stock-based compensation (and convertible preferreds) that are outstanding and not yet exercised.

3) Refer to the Notes to FS to see the Fair Value of remaining unexercised options and other share-based plans (ie. RSU’s). Reduce your intrinsic value of the firm by this amount.

This can be a large % of reported income that is being given to employees rather than the owners (shareholders) so it is an unfortunate but required step that we dig into the 10-K’s and not just trust the reported numbers.

David,

Check the trend of shares outstanding over the past 5-10 years. If the management dilutes a lot, a pattern you will see in technology companies, then you need to ask if you want to partner with the management. If yes then take the diluted shares outstanding to simplify things.

Regards,

Jana

Hi Jana

You’ve explained the basics very well. Thanks.

I have one question. In the financial statements presented on US GAAP standards how to present the deferred compensation expense. I increased my common stock and APIC now how to present that in the balance sheet and statement or equity.

Thanks

Ali